Hurricane Season is Here: Is Your Insurance Ready?

As hurricane season reaches its peak, homeowners and business owners in the Brazos Valley, Harris County, and Bryan, Texas, are reminded of the importance of having the right insurance coverage in place. At Van Dyke Rankin Insurance, we believe that preparation doesn’t end with the start of hurricane season. In fact, mid-season is a crucial time to review, adjust, and reinforce your insurance strategy.

Why Mid-Season Matters

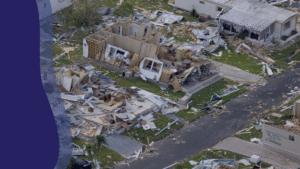

While it’s ideal to prepare before hurricane season begins, many people wait until storms are imminent to think about their policies. Fortunately, it’s not too late. Evaluating your coverage now can mean the difference between peace of mind and costly surprises after a storm.

Key Insurance Policies to Review

- Homeowners Insurance Make sure your homeowners policy covers windstorm damage, which may not be included in standard policies. Also, confirm whether you have replacement cost coverage or actual cash value—this affects how much you’ll be reimbursed for storm-related losses.

- Flood Insurance Flooding is a major risk during hurricanes, especially in areas like Harris County. Standard home insurance does not cover flood damage. Flood insurance must be purchased separately and often takes 30 days to take effect, so acting now is essential.

- Auto Insurance If your car is parked outside during a storm, comprehensive auto coverage can help cover damage from falling trees, hail, and flooding.

- Renters Insurance Renters should ensure their policies cover damage to personal belongings and consider temporary living expense coverage if their home becomes uninhabitable.

Steps You Can Still Take

Update Your Home Inventory: Document valuable belongings with photos and receipts. This makes the claims process much easier if you experience loss or damage.

Review Deductibles: Be aware of your windstorm or hurricane deductible. In some policies, this is a percentage of your home’s value rather than a flat amount.

Understand Your Policy Limits: Double-check that your policy limits are adequate to rebuild or replace your home and belongings.

Connect with Your Agent: The team at Van Dyke Rankin Insurance is available to review your current policies and suggest adjustments specific to the risks in your region.

Common Coverage Gaps to Address

- Flood damage (not included in standard policies)

- Additional living expenses during repairs

- Windstorm exclusions in basic home coverage

- Commercial insurance gaps for business owners affected by storm closures or property damage

Protecting More Than Just Property

Storm damage can impact more than your home. At Van Dyke Rankin Insurance, we also provide life and health insurance options to help protect your family’s financial stability during natural disasters.

Your Local Insurance Partner

Residents of Bryan and surrounding areas in the Brazos Valley trust Van Dyke Rankin Insurance for knowledgeable advice and comprehensive coverage. Whether you’re updating your policy or starting fresh, we guide you through every step to ensure you’re protected against hurricane season’s worst.

Don’t wait for a storm to check your coverage. Mid-season is a perfect time to act.

About Van Dyke Rankin & Company

Van Dyke Rankin & Company is a trusted commercial real estate firm serving Bryan, College Station, and the greater Brazos Valley region. With decades of experience and deep roots in the local community, our team specializes in commercial brokerage, property management, and investment real estate. Our client-first approach and commitment to integrity have made us a leader in Southeast Central Texas commercial real estate. Learn more at vandykerankin.com.